Description

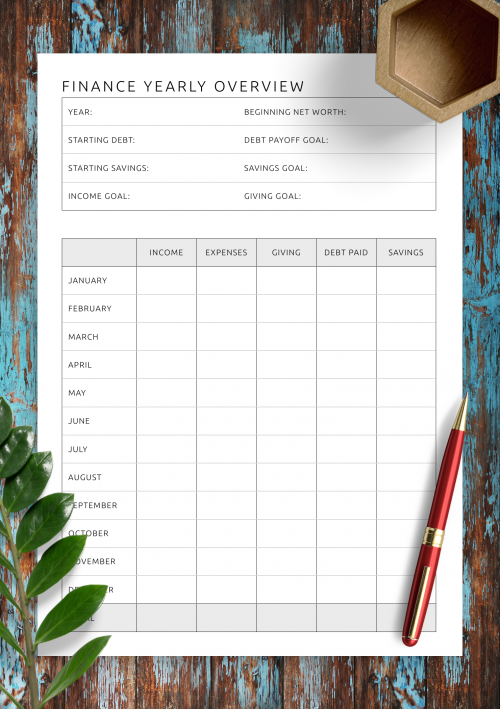

Welcome to our Comprehensive Financial Yearly Overview Template, designed to provide a detailed analysis of your financial performance over the past year. This template is meticulously crafted to assist you in gaining deep insights into your financial activities, enabling informed decision-making and strategic planning for the future.

Section 1: Executive Summary In this section, you will find a concise summary highlighting the year’s key financial metrics and trends. The executive summary offers a quick snapshot of your financial health, from revenue and expenses to profitability ratios and cash flow analysis.

Section 2: Revenue Analysis This section delves into revenue sources, including sales, services, and other income streams. Detailed breakdowns by product lines, customer segments, and geographical regions provide a comprehensive understanding of revenue generation dynamics.

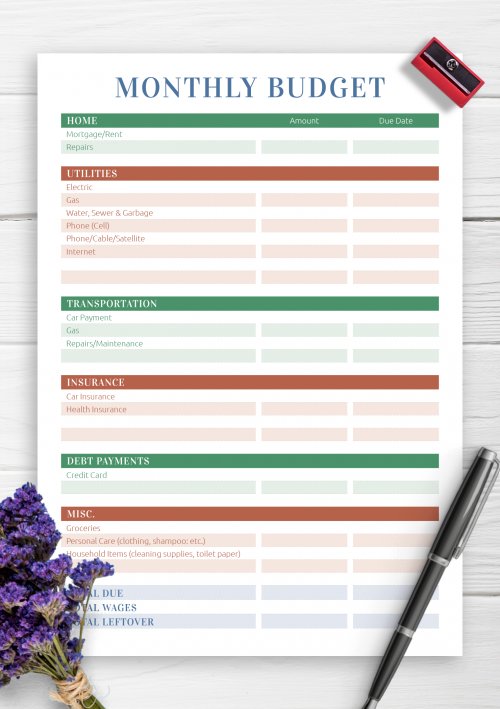

Section 3: Expense Management Here, you will find a thorough examination of your expenses across various categories, such as cost of goods sold, operating expenses, and administrative costs. Identifying areas of overspending or cost-saving opportunities is crucial for optimizing your financial performance.

Section 4: Profitability Assessment Evaluate your profitability through critical metrics such as gross profit margin, net profit margin, and return on investment. Understanding the drivers of profitability enables you to focus on strategies that enhance your bottom line.

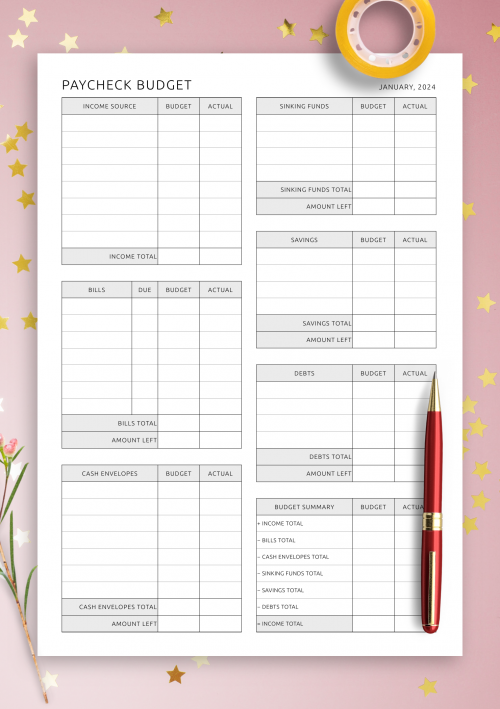

Section 5: Cash Flow Analysis Cash flow is the lifeblood of any business. This section analyzes your cash inflows and outflows, including operating, investing, and financing activities. Managing cash flow effectively is essential for maintaining liquidity and sustaining operations.

Section 6: Financial Ratios Assess your financial health using a range of ratios such as liquidity, solvency, and efficiency ratios. These ratios provide valuable insights into your liquidity position, debt levels, and operational efficiency.

Section 7: Budget vs. Actual Performance Compare your financial performance against the budgeted targets set at the beginning of the year. Variance analysis helps identify deviations from the plan and allows for corrective actions.

Section 8: Strategic Recommendations Based on the insights gathered from the analysis, this section offers strategic recommendations for improving financial performance in the upcoming year. Whether it’s optimizing expenses, diversifying revenue streams, or strengthening cash management practices, these recommendations aim to drive sustainable growth.

Jafar –

I can’t say enough good things about the Finance Yearly Overview Template! It’s helped me stay organized and accountable with my finances, allowing me to set realistic goals and track my progress throughout the year. I particularly love the monthly breakdowns, which make it easy to see where my money is going and where I can cut back. It’s been a game-changer for me!

Sekinat –

This template has completely revolutionized the way I approach budgeting and financial planning. It provides a comprehensive overview of my income, expenses, and savings goals, allowing me to make informed decisions about my finances. I appreciate how user-friendly it is, even for someone with limited financial knowledge. It’s been instrumental in helping me achieve my financial goals!

Itoro –

I’ve been using the Finance Yearly Overview Template for the past year, and I couldn’t be happier with the results. It’s helped me gain a better understanding of my spending habits, savings goals, and overall financial health. The visual charts and graphs make it easy to track trends and identify areas for improvement. It’s a must-have tool for anyone looking to take control of their finances!

Emma –

This Finance Yearly Overview Template has been an absolute lifesaver for me! As someone who struggles to keep track of finances, having everything laid out in a clear and organized manner has made managing my money so much easier. I love how customizable it is, allowing me to tailor it to my specific financial goals and needs.