Description

Welcome to our Monthly Household Budget Planner template, your ultimate tool for achieving financial stability and empowerment. Designed with user-friendly features and comprehensive sections, this template empowers you to take control of your finances, track your expenses, and set realistic financial goals. Whether you’re a budgeting novice or a seasoned pro, this planner offers a structured approach to managing your household finances efficiently.

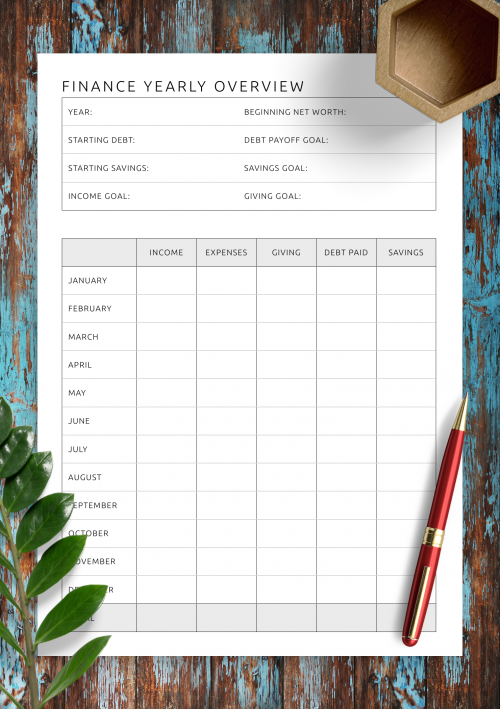

Section 1: Overview The Overview section helps you Gain a clear understanding of your financial landscape. Here, you’ll find an at-a-glance summary of your monthly income, expenses, savings, and economic goals. Use this section as your starting point to assess your current financial situation and plan accordingly.

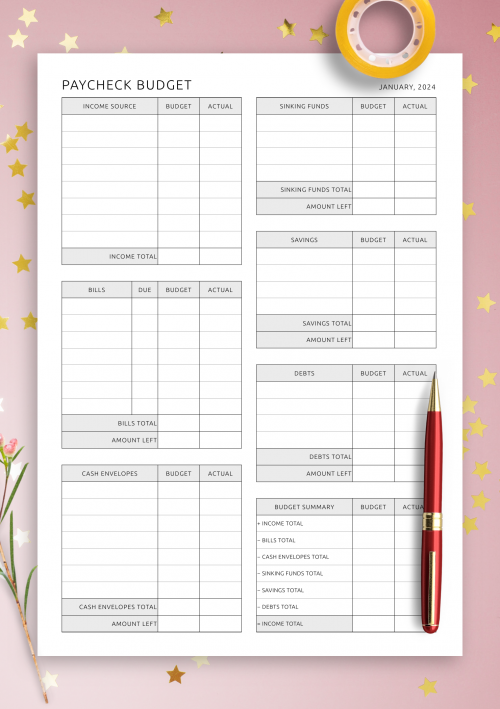

Section 2: Income Track your various income sources, including salaries, bonuses, freelance earnings, and other income streams. This section lets you input your expected and actual monthly income, providing insights into your overall earning potential.

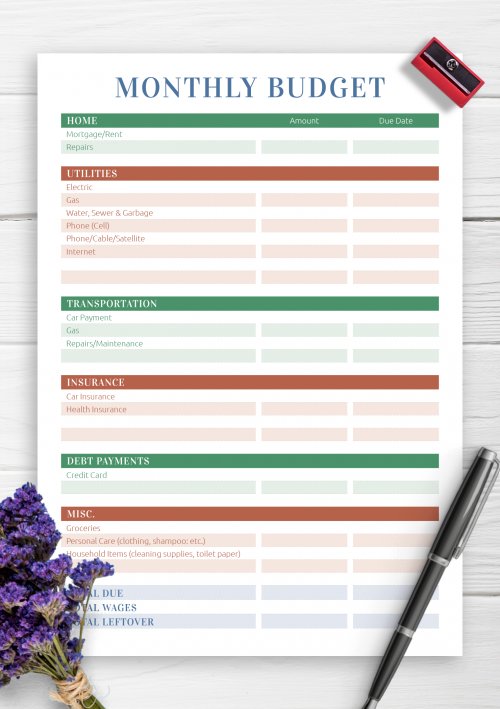

Section 3: Expenses Effortlessly monitor your expenses across different categories such as housing, utilities, groceries, transportation, entertainment, and more. By recording your expenses meticulously, you’ll gain valuable insights into your spending patterns and identify areas where you can cut back or optimize.

Section 4: Savings Establish and track your savings goals with precision. Whether saving for emergencies, retirement, or specific financial milestones, this section enables you to set targets, monitor progress, and adjust your savings strategy as needed.

Section 5: Budget Analysis Leverage the Budget Analysis section to evaluate your spending against your budgeted amounts. Visualize your spending patterns through intuitive charts and graphs, allowing you to identify trends, anomalies, and areas for improvement. This analysis lets you make informed decisions to align your expenses with your financial goals.

Section 6: Financial Goals Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals and track your progress over time. Whether you aspire to pay off debt, save for a vacation, or increase your investments, this section keeps you accountable and motivated on your financial journey.

Section 7: Notes and Reflections Document any insights, challenges, or observations related to your finances in the Notes and Reflections section. Use this space to brainstorm ideas, jot down financial strategies, or reflect on your progress toward financial freedom.

Nicholas –

As someone who struggled with keeping track of expenses, Household Budget has been a lifesaver! It’s intuitive, customizable, and has all the features I need to stay on top of my finances. Setting budgets for different categories has helped me curb overspending and prioritize my financial goals.

Ukamaka –

Household Budget has been a game-changer for me and my family! It’s incredibly user-friendly and has helped us gain control over our finances. I love how it categorizes our expenses and provides insights into where our money is going. Thanks to Household Budget, we’ve been able to save more and stress less about money management.

Shakirat –

Household Budget has truly revolutionized the way I manage my money. With its detailed reports and visualizations, I can easily identify areas where I can cut back and save more. The ability to set savings goals and track my progress has been incredibly motivating. Thanks to Household Budget, I’ve been able to pay off debt faster and work towards achieving my long-term financial aspirations.

Imaobong –

I’ve tried numerous budgeting apps in the past, but none have been as effective and easy to use as Household Budget. The interface is clean and straightforward, making it a breeze to input expenses and track my spending. The ability to sync across devices ensures that I always have access to my budgeting information wherever I go. It’s helped me become more mindful of my spending habits and make smarter financial decisions.